The 10 Don’ts of Mortgage Closing

Okay, so here we are... we have worked together to secure financing for your mortgage. You are getting a great rate, favourable terms that meet your mortgage goals, the lender is satisfied with all the supporting documents, we are broker complete, and the only thing left to do is wait for the day the lawyers advance the funds for the mortgage. Here is a list of things you should NEVER do in the time between your financing complete date (when everything is setup and looks good) and your closing date (the day the lender actually advances funds).

Never make changes to your financial situation without first consulting me. Changes to your financial situation before your mortgage closes could actually cause your mortgage to be declined.

So without delay, here are the 10 Don'ts of Mortgage Closing... inspired by real life situations.

1. Don't quit your job.

This might sound obvious, but if you quit your job we will have to report this change in employment status to the lender. From there you will be required to support your mortgage application with your new employment details. Even if you have taken on a new job that pays twice as much in the same industry, there still might be a probationary period and the lender might not feel comfortable with proceeding. If you are thinking of making changes to your employment status... contact me first, it might be alright to proceed, but then again it might just be best to wait until your mortgage closes! Let's talk it out.

2. Don't do anything that would reduce your income.

Kinda like point one, don't change your status at your existing employer. Getting a raise is fine, but dropping from Full Time to Part Time status is not a good idea. The reduced income will change your debt services ratios on your application and you might not qualify.

3. Don't apply for new credit.

I realize that you are excited to get your new house, especially if this is your first house, however now is not the time to go shopping on credit or take out new credit cards. So if you find yourself at the Brick, shopping for new furniture and they want you to finance your purchase right now... don't. By applying for new credit and taking out new credit, you can jeopardize your mortgage.

4. Don't get rid of existing credit.

Okay, in the same way that it's not a good idea to take on new credit, it's best not to close any existing credit either. The lender has agreed to lend you the money for a mortgage based on your current financial situation and this includes the strength of your credit profile. Mortgage lenders and insurers have a minimum credit profile required to lend you money, if you close active accounts, you could fall into an unacceptable credit situation.

5. Don't co-sign for a loan or mortgage for someone else.

You may have the best intentions in the world, but if you co-sign for any type of debt for someone else, you are 100% responsible for the full payments incurred on that loan. This extra debt is added to your expenses and may throw your ratios out of line.

6. Don't stop paying your bills.

Although this is still good advice for people purchasing homes, it is more often an issue in a refinance situation. If we are just waiting on the proceeds of a refinance in order to consolidate some of your debts, you must continue making your payments as scheduled. If you choose not to make your payments, it will reflect on your credit bureau and it could impact your ability to get your mortgage. Best advice is to continue making all your payments until the refinance has gone through and your balances have been brought to zero.

7. Don't spend your closing costs.

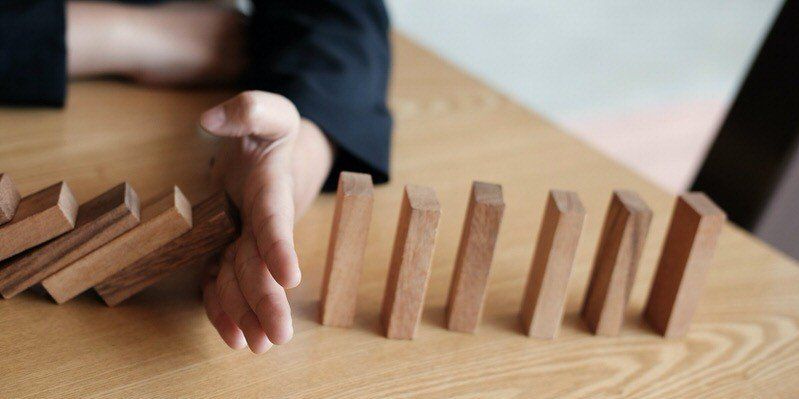

Typically the lender wants to see you with 1.5% saved up to cover closing costs... this money is used to cover the expense of closing your mortgage, like paying your lawyer for their services. So you might think that because you shouldn't take out new credit to buy furniture, you can use this money instead. Bad idea. If you don't pay the lawyer... you aren't getting your house, and the furniture will have to be delivered curb side. And it's cold in Canada. You get the picture. However just in case you don't, I included it below.

8. Don't change your real estate purchase contract.

Often times when you are purchasing a property there will be things that show up after the fact on an inspection and you might want to make changes to the contract. Although not a huge deal, it can make a difference for financing. So if financing is complete, it is best practice to check with me before you go and make any changes to the purchase contract.

9. Don't list your property for sale.

If we have set up a refinance for your property and your goal is to eventually sell it... wait until the funds have been advanced before listing it. Why would a lender want to lend you money on a mortgage when you are clearly going to sell it right away (even if we arranged a short term).

10. Don't accept unsolicited mortgage advice from unlicensed or unqualified individuals.

Although this point is least likely to impact the approval of your mortgage status, it is frustrating when people who don't have the first clue about your unique situation give you unsolicited advice about what you should do with your mortgage, making you second guess yourself. Now, if you have any questions at all, I am more than happy to discuss them with you. I am a mortgage professional and I help clients finance property everyday, I know the unique in's and out's, do's and don'ts of mortgages. Placing a lot of value on unsolicited mortgage advice from a non-licensed person doesn't make a lot of sense and might lead you to make some of the mistakes as listed in the 9 previous points!

So in summary, the only thing you should do while you are waiting for the advance of your mortgage funds is to continue living your life like you have been living it! Keep going to work and paying your bills on time!

Now... what about after your mortgage has funded? You are now free to do whatever you like! Go ahead... quit your job, go to part time status, apply for new credit to buy a couch and 78" TV, close your credit cards, co-sign for a mortgage, sell your place, or soak in as much unsolicited advice as you want! It's up to you! But just make sure your mortgage has funded first. Also it is good to note, if you do quit your job, make sure you have enough cash on hand to continue making your mortgage payments! The funny thing about mortgages is if you don't make your payments, the lender will take your property and sell it to someone else and you will be left on that curbside couch (as pictured above). Obviously, if you have any questions, I would love to answer them for you, feel free to contact me anytime!